Thailand’s New 2025 Tax Regulations: Comprehensive Updates and Significant Impact on Foreign Residents and Long-Term Visa Holders

Starting in 2025, Thailand’s tax regulations will undergo a comprehensive update, significantly affecting both foreign residents and long-term visa holders. From the definition of a tax resident to the scope of taxable personal income — including exemptions and deductions — each change in Thailand’s tax laws will directly impact individuals and businesses living and working in Thailand.

This article provides a detailed analysis of Thailand’s latest tax regulations for 2025, covering the following key points:

- Global income reporting requirements for tax residents

- Specific tax treatments for different visa holders

- Application of Double Taxation Agreements (DTA) to avoid double taxation

1. Definition of Thai Tax Residents and Tax Scope

According to Orders No. Por.161/2566 and No. Por.162/2566 issued by the Thai Revenue Department on September 15, 2023, from January 1, 2024, all income earned abroad by Thai tax residents — whether from employment, business, or property — will be subject to Thai personal income tax once transferred to Thailand.

Previously, only foreign income remitted to Thailand within the same tax year was taxable.

Definition of a Thai Tax Resident

Under the new directive, any individual residing in Thailand for a total of 180 days or more within a calendar year will be classified as a Thai tax resident. Tax residents are required to report and pay taxes on their worldwide income according to Thai tax laws.

Example Cases:

Example 1: Ms. Wang’s Full-Year Stay

- Ms. Wang entered Thailand on January 5, 2024, and left on December 28, 2024, without leaving the country during that period.

- She stayed in Thailand for 358 days, exceeding the 180-day threshold.

- Therefore, Ms. Wang is classified as a Thai tax resident for 2024 and must declare her global income.

Example 2: Mr. Li’s Split Stays

- Mr. Li entered Thailand from March 1 to June 15, 2024 (106 days) and from September 1 to December 20, 2024 (111 days).

- His total stay amounted to 217 days in 2024.

- Since his total stay exceeds 180 days, Mr. Li qualifies as a Thai tax resident and must declare his global income.

Example 3: Ms. Chen’s Short-Term Stays

- Ms. Chen visited Thailand twice in 2024: from April 1 to May 30 (60 days) and from November 1 to December 15 (45 days).

- Her total stay was 105 days, which is below the 180-day threshold.

- Therefore, Ms. Chen is not considered a Thai tax resident and only needs to pay taxes on Thailand-sourced income.

Exceptions:

Certain types of foreign income may receive special treatment:

- Income already taxed in the source country may be eligible for tax credit under a Double Taxation Agreement (DTA).

- Some income, such as inheritance or living allowances up to 20 million THB, may be tax-exempt.

Future Policy Changes:

Thai tax authorities are reportedly considering future amendments that could require tax residents to pay taxes on global income even if the funds are not transferred into Thailand.

2. Tax Requirements for Long-Term Visa Holders

Under the latest tax regulations, different types of long-term visa holders are subject to specific tax obligations:

O-A Retirement Visa, Thai Elite Visa, and Destination Thailand Visa (DTV):

- If staying in Thailand for more than 180 days in a calendar year, the holder will be considered a Thai tax resident.

- Global income transferred into Thailand after January 1, 2024, is subject to taxation.

- Global income not transferred into Thailand is not taxable.

Long-Term Resident (LTR) Visa Holders:

- Highly Skilled Professionals

- Eligible for a 17% reduced personal income tax rate (applies to specific sectors like technology, healthcare, and science).

- Other LTR Visa Holders

- Wealthy Global Citizens, Wealthy Pensioners, and Remote Working Professionals

- Foreign income is tax-exempt if not transferred into Thailand.

3. Taxable Income Categories Under Thai Tax Law

Taxable income in Thailand is divided into eight main categories:

- Wages and salaries – Base salary and bonuses from employment contracts.

- Service and agency fees – Consultancy and intermediary service fees.

- Royalties – Income from patents, copyrights, and trademarks.

- Interest and dividends – Bank deposit interest and stock dividends.

- Rental income – Income from leasing real estate or movable assets.

- Professional fees – Income from professional services like legal and medical work.

- Contractor income – Income from contract projects.

- Business and other income – Business operations, equity transfers, etc.

4. Personal Income Tax Rates (2025)

Thailand will continue to apply progressive tax rates in 2025:

| Income Range (THB) | Tax Rate |

|---|---|

| 0 – 150,000 | Exempt |

| 150,001 – 300,000 | 5% |

| 300,001 – 500,000 | 10% |

| 500,001 – 750,000 | 15% |

| 750,001 – 1,000,000 | 20% |

| 1,000,001 – 2,000,000 | 25% |

| 2,000,001 – 5,000,000 | 30% |

| Over 5,000,000 | 35% |

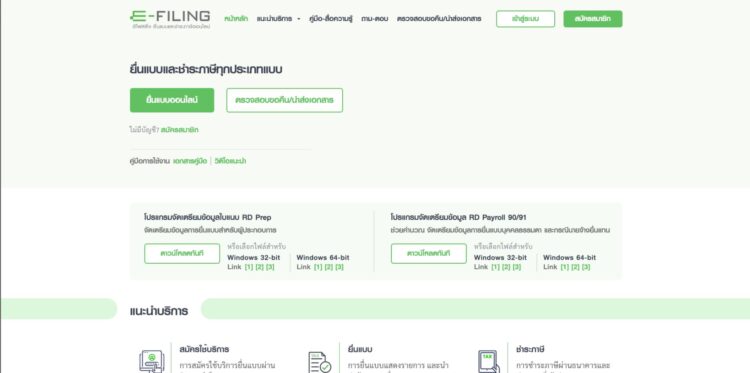

5. Tax Filing Methods and Deadlines

Filing Deadlines:

- Paper filing: March 31 each year

- Online filing: April 8 each year

Filing Methods:

- Offline Filing:

- Submit forms at regional or district tax offices.

- Use Form P.N.D. 90 or P.N.D. 91.

- Online Filing:

- File via the Thai Revenue Department website (www.rd.go.th) or the RD Smart app.

6. Tax Exemptions and Deductions

Foreigners residing in Thailand are entitled to various exemptions and deductions:

✔️ Personal and Family Deductions:

- Personal exemption: 60,000 THB per person

- Spouse exemption (if unemployed): 60,000 THB

- Child deduction: 30,000 THB per child (60,000 THB for second and subsequent children born after 2018)

✔️ Insurance Deductions:

- Life insurance premium: up to 100,000 THB

- Health insurance premium: up to 25,000 THB

✔️ Retirement and Savings Deductions:

- RMF contribution: up to 500,000 THB

- PVD contribution: up to 500,000 THB

7. Double Taxation Agreements (DTA)

Thailand has signed DTAs with 61 countries to avoid double taxation. For example:

- China-Thailand DTA: 15% withholding tax on dividends (10% if holding >25% equity)

- Taiwan-Thailand DTA: 10% withholding tax on dividends, interest, and royalties

✅ Application Process:

- Taxpayers must provide a tax residency certificate to benefit from reduced rates under DTA.