Introduction

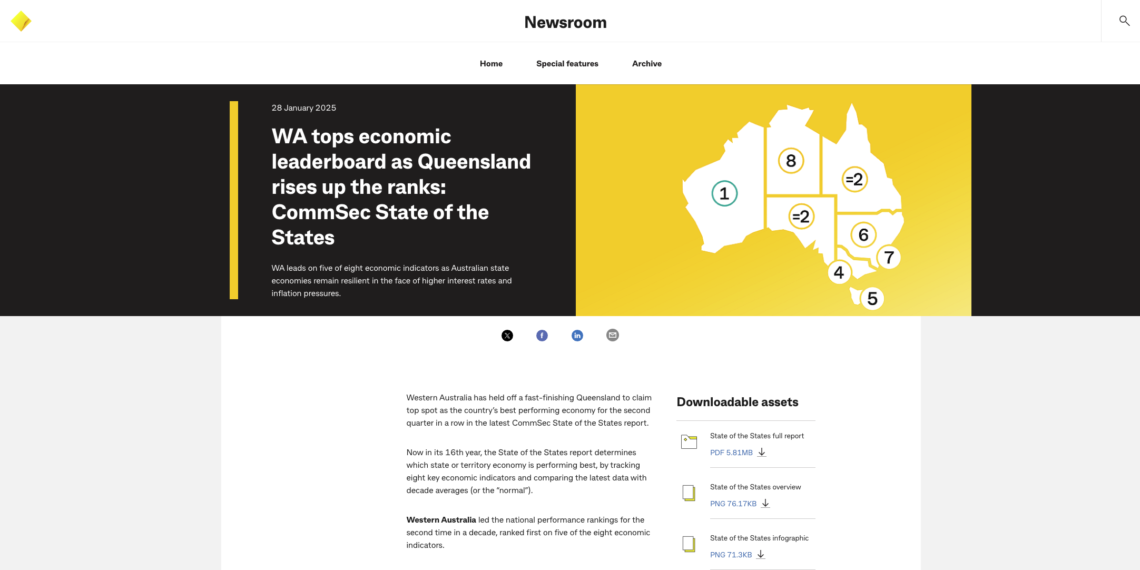

The State of the States report released in January 2025 reveals that Western Australia (WA) has once again emerged as the top-performing state in Australia’s economic rankings. The report evaluates the economic performance of each state and territory based on eight key indicators: economic growth, retail spending, equipment investment, labour market, construction activity, population growth, housing finance, and residential construction starts. Resource-driven states such as Western Australia and Queensland performed particularly well, thanks to strong resource exports, a robust real estate market, and solid population growth.

Queensland and South Australia shared second place, reflecting steady performance in housing finance, economic growth, and employment. Victoria ranked fourth, supported by strong construction activity. New South Wales (NSW) climbed to sixth place, overtaking the Australian Capital Territory (ACT), indicating a rebound in economic momentum. Meanwhile, Northern Territory (NT) remained at the bottom of the rankings, held back by weak equipment investment and residential construction activity.

Despite the ongoing pressure from high interest rates and inflation, the report notes that Australia’s overall market remains resilient, particularly in the labour and real estate sectors. Future economic performance will depend on easing inflation pressures, sustained employment growth, and government policies aimed at stimulating domestic demand and supporting industry development.

1. Economic Growth: South Australia Leads, Queensland Follows

In terms of economic growth, South Australia (SA) led the nation, with economic activity in the September 2024 quarter 8.4% above the long-term average. This strong momentum was driven by export growth, infrastructure investment, and stable real estate development.

Queensland ranked second, with economic activity 7.9% above the long-term average. The state’s performance was boosted by resource exports, rising market demand, and population growth. The strength of Queensland’s resource and real estate sectors underpinned this growth.

ACT ranked third (+7.0%), supported by stable government spending and public service growth. Victoria (+5.9%), NSW (+5.8%), and Tasmania (+5.3%) showed moderate but stable growth.

At the lower end, Northern Territory remained the weakest, with economic activity 3.2% below the long-term average, reflecting challenges in resource exports and domestic demand.

| State/Territory | Economic Growth (%) | Rank |

|---|---|---|

| South Australia | +8.4% | 1st |

| Queensland | +7.9% | 2nd |

| ACT | +7.0% | 3rd |

| Victoria | +5.9% | 4th |

| NSW | +5.8% | 5th |

| Tasmania | +5.3% | 6th |

| Western Australia | +0.7% | 7th |

| Northern Territory | -3.2% | 8th |

2. Retail Spending: WA Takes the Lead, Victoria Follows

Despite inflation and rising interest rates, retail spending remained robust. Western Australia topped the rankings, with retail spending 11.2% above the long-term average. This was supported by a strong labour market and population growth, driving increased demand in food, household goods, and building materials.

Victoria ranked second (+9.5%), with steady employment and population growth driving spending, especially in housing-related sectors such as furniture and appliances. Queensland followed closely (+9.4%), buoyed by a rebound in tourism and services.

At the lower end, Northern Territory showed the weakest growth (+2.4%) due to its smaller economy and weaker domestic demand.

| State/Territory | Retail Spending Growth (%) | Rank |

|---|---|---|

| Western Australia | +11.2% | 1st |

| Victoria | +9.5% | 2nd |

| Queensland | +9.4% | 3rd |

3. Equipment Investment: Northern Territory Leads National Recovery

Northern Territory led the nation in equipment investment, which was 40.3% above the long-term average in the September 2024 quarter. This was driven by increased spending in mining and infrastructure projects.

Tasmania ranked second (+25.2%), supported by infrastructure and tourism-related projects, while Western Australia ranked third (+23.2%) due to demand in the mining and construction sectors.

| State/Territory | Equipment Investment Growth (%) | Rank |

|---|---|---|

| Northern Territory | +40.3% | 1st |

| Tasmania | +25.2% | 2nd |

| Western Australia | +23.2% | 3rd |

4. Labour Market: WA Posts the Strongest Job Market

In December 2024, Western Australia had the lowest unemployment rate at 3.4%, 34.7% below the long-term average, reflecting strong demand in the mining and construction sectors.

South Australia ranked second with a 4.0% unemployment rate, benefiting from increased infrastructure and manufacturing jobs. Queensland followed at 4.1%, driven by resource exports, tourism, and real estate growth.

At the weaker end, Victoria had the highest unemployment rate at 4.5%.

5. Construction Activity: Victoria Leads the Sector

In the September 2024 quarter, Victoria led construction activity, with total value 16.1% above the ten-year average, driven by major infrastructure and residential projects.

South Australia (+15.4%) and Tasmania (+10.7%) followed, supported by steady residential and commercial construction.

6. Population Growth: WA Outpaces the Rest

In the June 2024 quarter, Western Australia recorded the highest annual population growth rate at 2.82%, 76% above the ten-year average. This was driven by strong labour demand in the resource sector.

Victoria (+2.42%) and Queensland (+2.30%) ranked second and third, respectively.

7. Housing Finance: WA and Queensland Dominate

Western Australia led the housing finance category, with loan volumes up 39.4% from the long-term average, driven by strong demand for new and existing homes.

Queensland ranked second (+36.8%), followed by South Australia (+22.4%).

8. Residential Construction: WA Tops Rankings

In the September 2024 quarter, Western Australia led residential construction starts (+10.8%), reflecting increasing housing demand driven by population growth and resource sector activity.

Summary

Australia’s 2025 economic landscape reflects strong performance in resource-driven states and a resilient labour and housing market.

- Western Australia and Queensland benefited from resource demand and population growth.

- Victoria maintained strength in construction and housing finance.

- South Australia posted the strongest economic growth.

Future performance will depend on the easing of inflation, continued employment growth, and targeted government support for industry and domestic demand.