[閱讀中文版 Read Chinese Version:按此 Click here ]

As the year 2024 begins, professionals in the real estate industry have expressed a wide range of diverse views on future market trends. These perspectives cover everything from macroeconomic factors to specific regional market dynamics, exploring how they will impact future investment decisions. Therefore, Zagdim conducted a survey with industry professionals, interviewing over 2,000 individuals from different countries and regions, and from various property-related professions (property consultants, immigration consultants, accountants, lawyers, mortgage advisors, and developers) to understand their views on the property markets of various countries for 2024.

本文目錄

Global Interest Rate Changes and Market Outlook

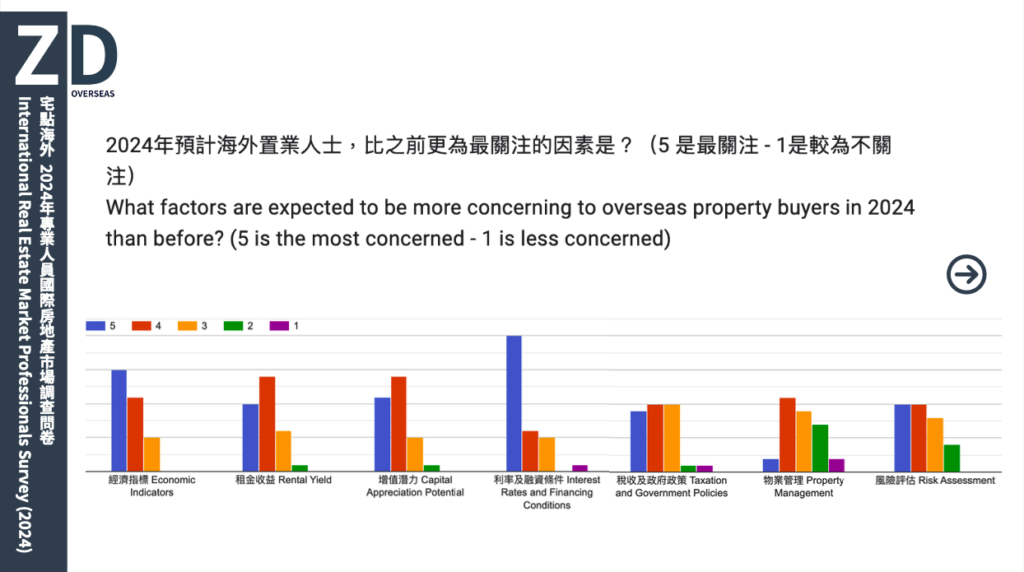

Globally, changes in interest rates have been a significant factor affecting the real estate market. In recent years, many countries’ central banks have adopted interest rate cuts to stimulate the economy, directly impacting the real estate market. Experts generally expect that further adjustments in interest rates will boost homebuyers’ confidence, thereby stimulating real estate transactions. Over 60% of respondents believe that the overall transaction volume will increase this year, and over 70% think that interest rates will be an important factor affecting real estate.

Regional Focus: Investment Potential in the UK, Asia, and the Middle East

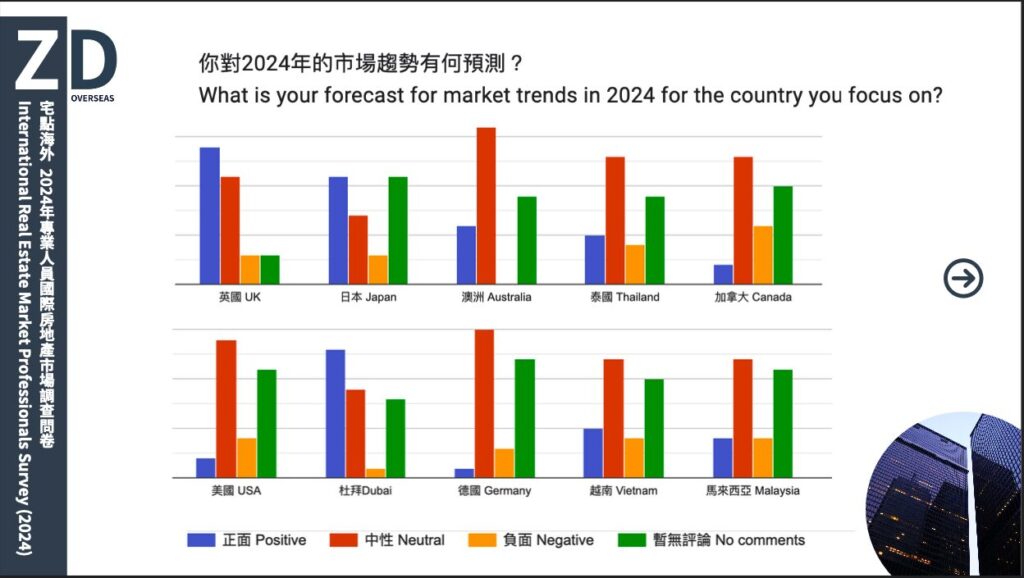

The real estate market in the UK, especially in London and Birmingham, has attracted attention due to its solid economic foundation and resilience during the pandemic. Professionals believe that BTR (Build to Rent), PBSA (Purpose-Built Student Accommodation), and retirement living communities will be hotspots for future investment. The growing demand in these areas, coupled with interest rate adjustments, suggests a new wave of activity in the real estate market.

Japan has become an attractive investment location due to its open foreign labor policy and the upcoming 2025 Osaka Expo. These factors are expected to enhance the property values in smaller cities. Additionally, Japan’s leadership in earthquake-resistant technology makes it a relatively safe investment choice.

Dubai and Vietnam are considered investment hotspots due to their stable political environments, rapid economic development, and favorable tax policies. Australia is viewed positively due to its anticipated population growth.

Investment Types: The Outlook for Residential and Commercial Real Estate

Residential real estate remains a focal point for investors. With attractive rental yields and long-term price increases, this sector shows strong investment potential. Moreover, industrial real estate and prime urban locations are significant investment options, often facing supply shortages with consistently high demand.

Emerging Concepts and Future Trends

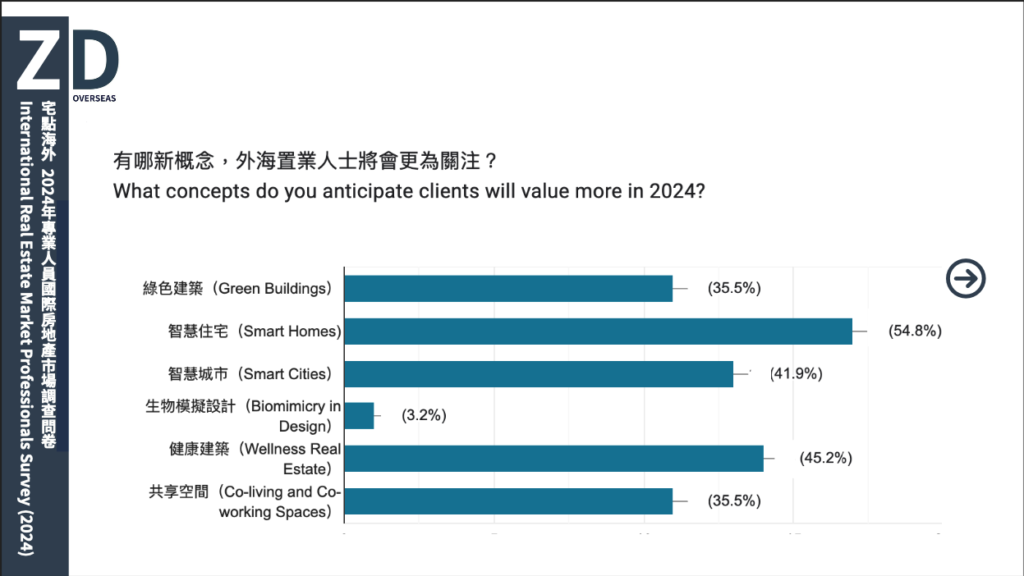

Advancements in technology are gradually changing the way people live and work, with emerging concepts such as smart homes, healthy buildings, smart cities, green buildings, and shared spaces. These trends not only influence buyers’ decisions but also offer new opportunities for investors. Professionals widely believe these areas will become market focal points in the coming years.

Conclusion: Real Estate Investment Opportunities in 2024

In summary, the investment opportunities in real estate for 2024 are widespread, from urban and suburban areas in the UK to economic growth points in Asia, to special policy-driven markets in the Middle East and Europe. Investors making decisions will need to consider a variety of factors, including interest rate changes, regional economic development, demographic dynamics, and policy environments, to seize the investment opportunities in 2024.