Rental market in #London along Covid: short statistical story of its Before and After, Ups and Downs

–

Back to June 2020, we conducted a UK property analysis and suggested that – Zone 3 or out-skirt-zones shall be the main focused investment areas under the Covid period, as we found that the epidemic would increase the demand for living outside of the ‘circle’, and this would raise pressure on the renting in zone1 and zone 2.

Let’s see what’s happening now, look

#Downs

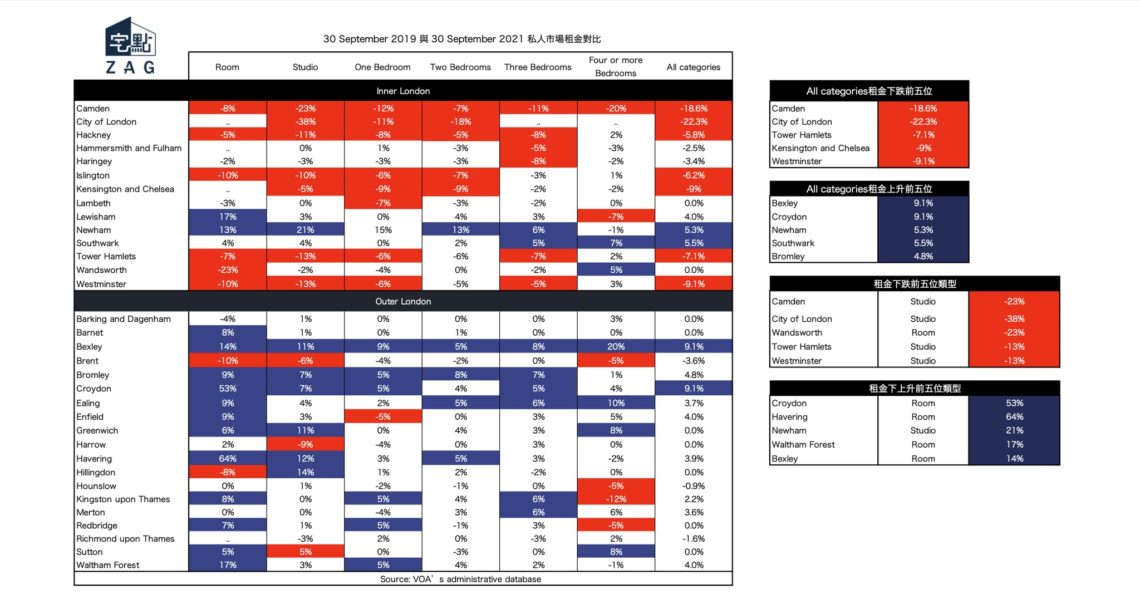

Inner London fell by 5% overall, while Outer London rose by 2% on average. The City of London represented by Zone 1, and Camden experienced the most serious decline, with rents falling by 22.3% and 18.6%. The main declining house type of Inner London was Studio, down by 6%, among which the biggest decline was Studio of City of London, down by 38%, followed by Wandsworth and Camden, down by 23%.

#Ups

The biggest increases were in Bexley and Croydon of Outer London, with the same increase of 9.1%. The main type of increase in Outer London was Room, with an average increase of 10%. The Room of Havering and Croydon especially increased by 64% and 53%. But note that this increase is mainly due to the large base, for example, Havering increased from 412 to 675.

–

From the figures, we can have a glance of characteristics and future trends. To further #followup this #story, subscribe our #ZagdimWeekly to keep updated with our Research

#ZagdimWeekly to keep updated with our Research Lab: https://lnkd.in/gXQ-imnD

**

The data is from VOA’s administrative database, compared with the private renting market of 30 September 2019 and 30 September 2021.