Chief editor of Zagdim recently met with veteran bankers in dinner and discussed the outlook of the investment market this year, which is worth sharing with our readers.

The two main themes for this year’s investment market are the two E’s; Emerging Market and Europe, based on the megatrends of the US dollar peaking and falling, complemented by China’s recovery. As for the asset class, the interest rate hike cycle is coming to an end and interest rates are close to peaking, but inflation expectations are still relatively high, the rebound in the property market should not be underestimated and it has been revealed that overseas funds and local investors are already re-investing in the London property market.

Wrong assumptions about the pessimistic UK and London property markets

Banker’s optimistic view of the UK and London property market in particular is poles apart from the mainstream market consensus that the property market there will continue to bottom out, with a fall of between 5-10% this year. The easiest and most straightforward way to prove whether there will be another ‘consensus kill’ is to analyse whether the pessimistic assumptions about the UK and London property markets are valid at this point in time or have changed.

Hypothesis 1: A further rise of UK interest rates will push down property prices?

There is no denying that the slowdown in UK property prices over the last six months, and the five consecutive monthly falls in property prices, have been largely due to interest rate rises. However, at the Bank of England meeting in February, the central bank raised interest rates by half a per cent but “pigeonholed” them, and even lowered its annual inflation forecast.The market is expecting a further increase of 0.25% in the official UK interest rate, bringing the cycle of interest rate hikes to an end.

*Bloomberg, Nationwide

Overnight index swap rates reflect UK interest rate expectations

| Prediction in Jan | Latest Prediction | |

| Expected interest rate when June | 4.5% | 4.319% |

| Expected interest rate end of the year | 4.55% | 4% |

With reference to the latest prices of overnight index swap rates (OIS), market forecasts for UK interest rates at mid-year and year-end have been further reduced and are even beginning to reflect the possibility of an interest rate cut at the end of the year. Given that the level of interest rates on fixed-rate mortgages, which account for the largest share of UK mortgages, is dependent on interest rate expectations and debt rates, this latest environment undoubtedly also signals further reductions in UK fixed-rate mortgage rates.

In fact, if we compare the monthly changes in property prices with the trend in mortgage rates over the last year, the biggest month-on-month falls in property prices occurred in October and November, coinciding with a sharp rise in mortgage rates as a result of rising expectations of interest rate rises and bond market turbulence, with the two-year fixed rate rising to 6%. As mortgage rates gradually fell to around 4% and a half, there were signs of a stabilization in property price performance. It is safe to say that the worst of the interest rate impact on the UK property market is over.

相關閱讀:

Pound exchange rate signals rebound in property prices

*Bloomberg, Nationwide

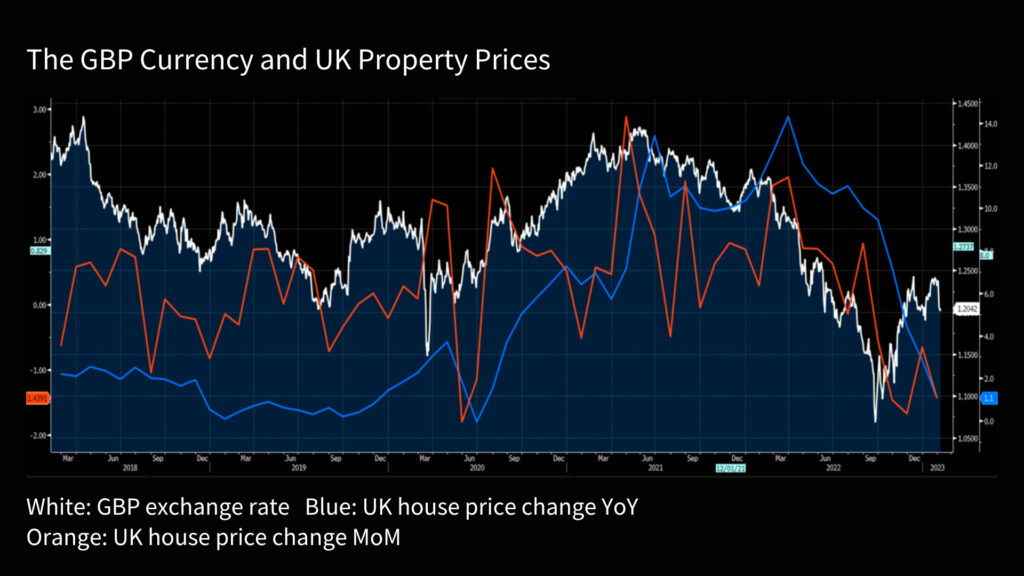

Apart from interest rates, the performance of the UK property market, both good and bad, is highly correlated with the performance of the stock and exchange markets, particularly the pound. The chart shows that there has been a fairly consistent positive correlation between the pound exchange rate and the performance of local property prices on a monthly and yearly basis for most of the last five years, with the exception of recent months when the two movements have clearly diverged. It is generally believed that the property market will have the ability to catch up when the interest rate trend becomes clearer.

Hypothesis 2: Would a large number of financial jobs move out of the UK after Brexit putting London property prices under pressure?

London property prices have fallen across the country since 2017, partly due to concerns that large multinational financial institutions would have to move out of London or reduce their local workforce as a result of Brexit, but figures suggest otherwise. According to an Ernst & Young report published last year, around 7,000 financial jobs have been transferred from the UK to other parts of Europe since the EU referendum, far fewer than the 40,000-100,000 jobs estimated by various organizations a few years ago. It is untenable to infer from the change in the number of financial jobs that ‘London is losing its attractiveness as an international financial center’.

Price gap between London and other regions narrows

Hypothesis 3: London is unattractive to buyers due to high property prices?

Numerically, this may be a misconception. While London is undoubtedly the most expensive city in the country, with an average property price of over £500,000, the gap with London has narrowed over the past few years as local buyers and foreign capital have poured into property outside London. For example, in 2016 London was on average 3.2 and 2.95 times more expensive than Greater Manchester and Birmingham respectively, but has now fallen back to a relatively normal level of 2.44 and 2.41 times.

In terms of rental returns, London’s rental return has rebounded from around 2% at the time of the epidemic to 4%, which is a very reasonable rate at the moment. London is also facing a shortage of supply, with an additional supply of over 37,000 houses/apartments in 20/21, well below the London Plan’s target of 50,000 houses/apartments per year.

Even though the UK existing property prices were still down in January, the FTSE EPRA Nareit UK Index, an index of UK property developers and property funds, rose by 7.4% last month, outperforming the FTSE 100 index, more or less reflecting that stock market investors are more optimistic than physical property investors about the future of the market.

Late last year, funds were first poured into market in London

As banker had noted, the return of foreign and local capital has been a major catalyst for the London property market, with some property advisers revealing that the dramatic market shocks caused by the mini-budget last November had led to a large number of overseas investors taking advantage of the cheapness of the exchange rate and flowing into the local property market, with London, where prices are higher, accounting for the largest share. Similarly, according to the EFPR’s weekly capital flow figures, the pound has been receiving capital inflows for at least eight weeks in a row, which is evidence of renewed inflows into UK assets from overseas investors.

Property prices rise across the UK in January

| Source | Areas/cities where property prices rebound | Jan Price Change (mom)(%) |

| Rightmove | London | 0.20 |

| North West | 1.50 | |

| West Midlands | 0.90 | |

| South East | 0.10 | |

| East Midlands | 1.80 | |

| North East | 1.00 | |

| ONS | London | 0.12 |

| Manchester | 1.21 | |

| Salford | 0.72 | |

| Brightton & Hove | 1.44 | |

| Reading | 0.61 | |

| Leicester | 0.61 |

In fact, according to figures from two major organisations, property prices in a number of UK regions returned to a one-month increase in January, with London also on the list, although the rate of increase was relatively low.

In July last year, figures released by Benham & Reeves put the number of properties in England held by overseas buyers at around 241,711, with London topping the list with over 85,000 properties (around 35 per cent of the total). In other words, the inflow of capital, especially with the expected bottoming out of the pound, will drive more foreign capital to London, where property prices have lagged behind those of the rest of the country for many years.

Domestic residents excessive savings need to find a way out

*Bloomberg

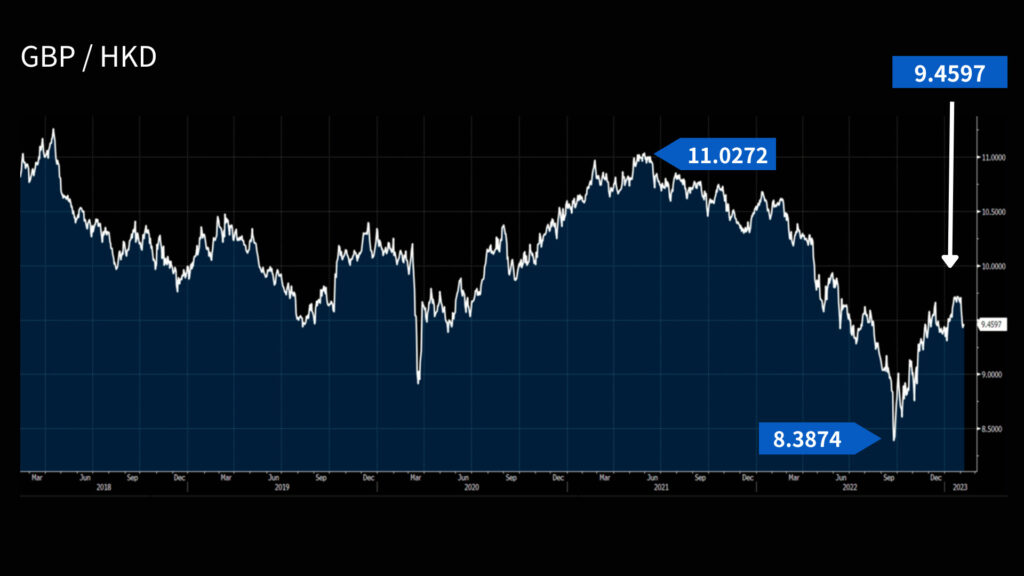

It is well known that Hong Kong buyers have provided much of the purchasing power for the UK property market in recent years. According to a survey conducted by the British Overseas Chinese Association two years ago, London is the top choice for Hong Kong people buying in the UK. Although the pound has rebounded, it is still below the ‘tenth percentile’ level against the Hong Kong dollar, now around 14% below its 21-year high and still 9% below its pre-epidemic level at the end of 19. The still relatively cheap cost of exchange, but with the expectation of a rise in the exchange rate, should encourage and even accelerate the uptake of the previously considered less affordable London region by more prospective Hong Kong buyers.

China’s border reopening brings new funding arrangements

Domestic capital is a force to be reckoned with, as a large amount of money invested in wealth management products and the property market has been re-invested in deposits over the last year, with Citi calculating that the size of excess deposits is between RMB 4-12 trillion. Many analysts agree that the large amount of excess deposits in China will provide upside potential in both domestic and international asset markets, particularly in overseas property markets, with the Knight Frank 2023 Global Luxury Property Outlook reporting that over 90% of affluent Chinese are interested in buying a house/apartment this year, with London being the city of choice for the next few years.

Selection of quality brands

If one agrees that mainstream analysis is overly pessimistic about the UK property market and that foreign capital is being reinvested in London property, the next question is how to choose. Apart from the location and price of London, the other key to buying in the UK is the property itself and its brand. The ‘Berkeley effect’ has long been known in the UK, meaning that the presence of the Berkeley Group brand will drive property prices in the area. The ‘Berkeley effect’ came about after the London Olympics in 2012, when the London Assembly was actively promoting an urban regeneration programme, and Berkeley Group was already in place at the same time, focusing on the relatively large-scale urban regeneration of the London area, which allowed Berkeley Group to secure better locations. Until today, Berkeley Group has 72 ‘completed and ongoing’ projects in London, mainly in west London locations, particularly along railway stations.

*Blue is completed Red is to be completed

The quality of the location has given Berkeley Group’s projects better bargaining power in terms of rents. According to the rent data collected by Zagdim Overseas, the figures show the strength of the Berkeley Group. A cross-sectional comparison between the Berkeley Group and the average rents in the area shows that the overall rents in the Berkeley Group are generally higher than the average rents in the same area by around 13.3-31.7%, which shows the strength of the Berkeley Group.

相關閱讀:

Although the uncertainty surrounding UK property prices is slowly diminishing, there is still uncertainty on the outside and it is particularly important for overseas investors to find a strong and reliable property developer when buying a property.